Starting the year, we present our views on country allocation within an EGBs portfolio.

To do this, we first examine the relative positioning of the main EA countries in 2025 according to our EA scorecard (see the Appendix for more details on our scorecard methodology).

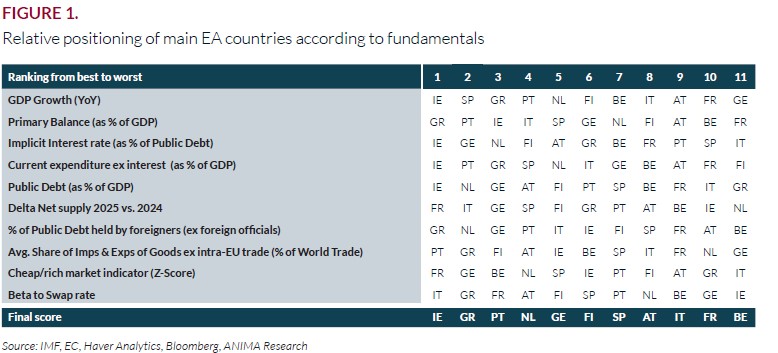

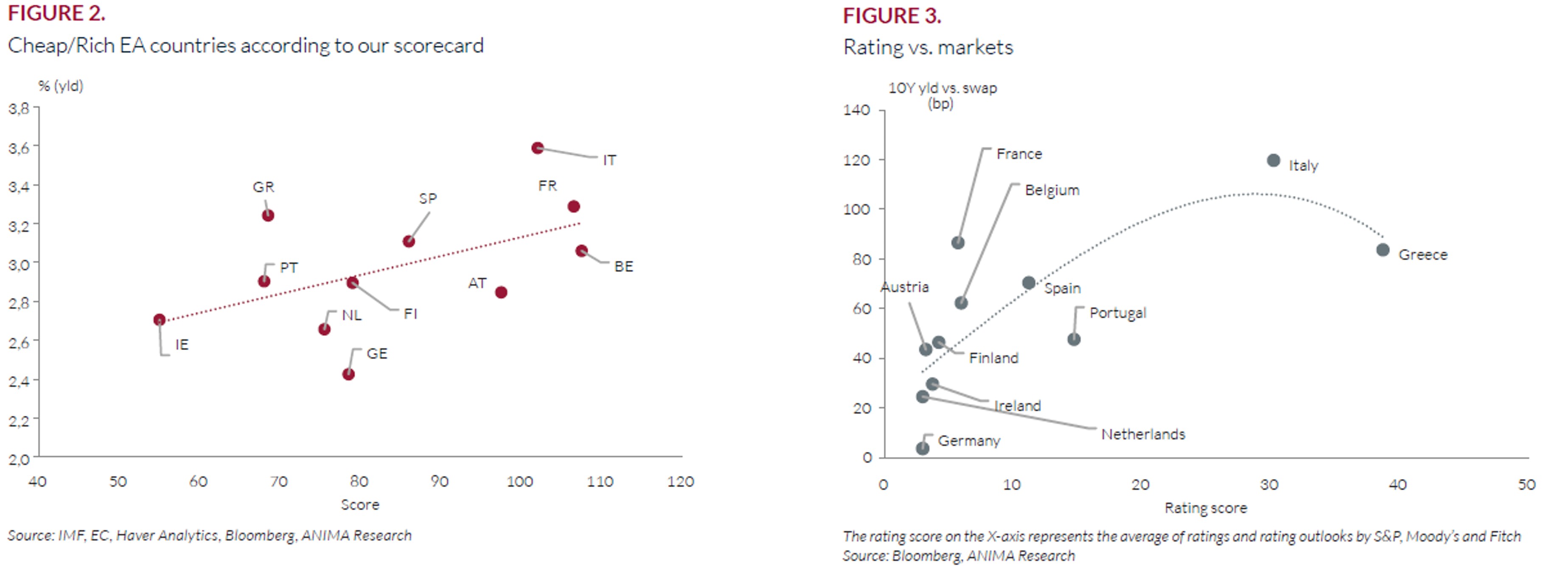

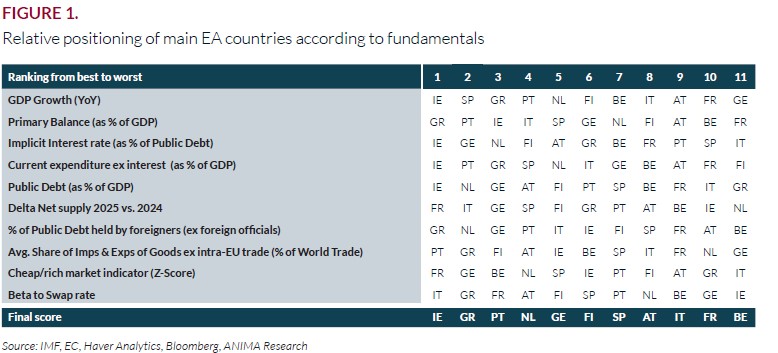

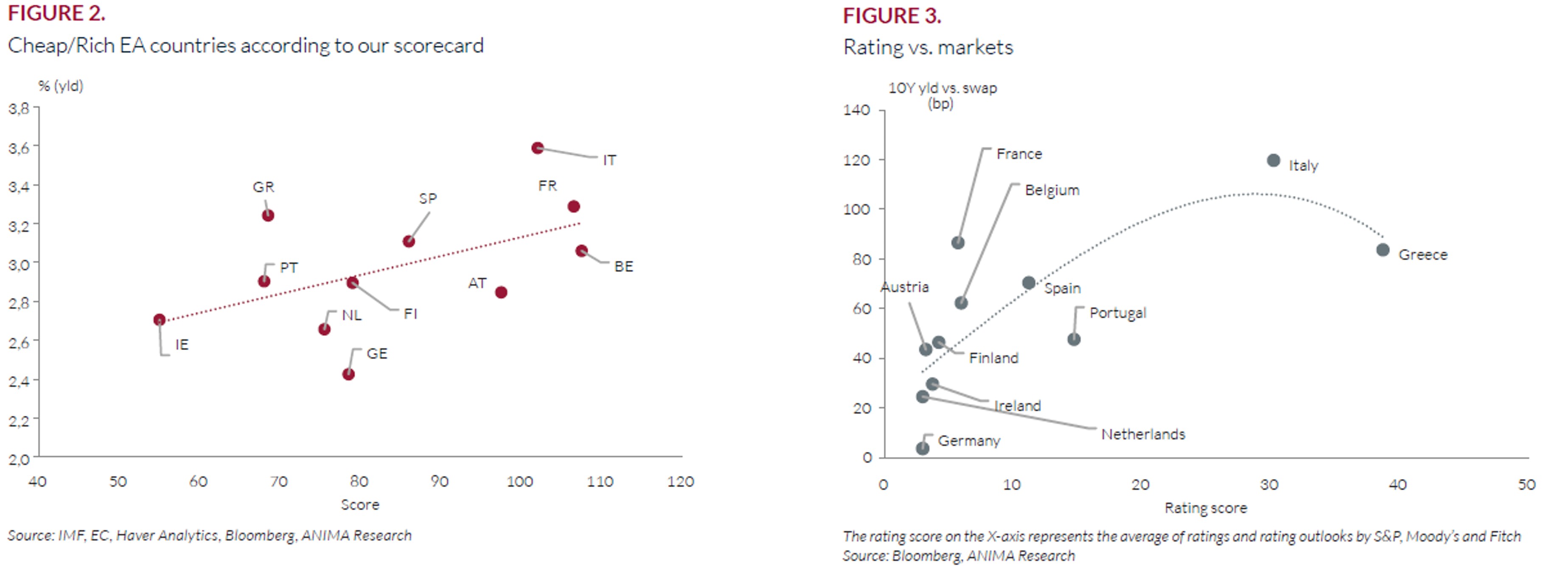

Figure 1 shows the ranking of main EA countries in 2025 based on growth, debt metrics, openness to trade, and market valuation, while Figure 2 compares each country’s final score with their 10Y yields. According to our scorecard:

- While periphery-core spreads have tightened significantly since the end of 2023, core and semi-core countries remain overvalued relative to their fundamentals, while periphery countries continue to trade cheap (Figure 2).

- Within the core group, Germany stands out due to the significant misalignment between fundamentals and valuation (in terms of richness, Figure 2). This is also confirmed by Figure 3, which compares the rating to the valuation of main EA countries. Compared to other EA countries, Bunds trade much tighter vs. swap than other countries’ govies with comparable ratings. In our view, this reflects the fact that Bunds are still largely held by price-insensitive investors (26% by the Bundesbank and 29% by foreign officials at the end of Q2 2024, according to the IMF) and that the outstanding amount of high-rated liquid government bonds in the EA is much lower than in the U.S.

- Within the periphery, Italy shows the largest misalignment between fundamentals and valuations (in terms of cheapness, Figure 2). Figure 3 also confirms that Italy trades cheaply vs. swap compared to its rating.

- France ranks poorly in terms of fundamentals, and after the last six months of OATs cheapening compared to the rest of EGBs, its valuation is only slightly cheap compared to its fundamentals.

Chiara Cremonesi

Senior Rates Strategist

Investment Research

Marketing material for professional clients or qualified investors only.

This material does not constitute an advice, an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. ANIMA can in no way be held responsible for any decision or investment made based on information contained in this document. The data and information contained in this document are deemed reliable, but ANIMA assumes no liability for their accuracy and completeness.

ANIMA accepts no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material in violation of this disclaimer and the relevant provisions of the Supervisory Authorities.

This is a marketing communication. Please refer to the Prospectus, the KID, the Application Form and the Governing Rules (“Regolamento di Gestione”) before making any final investment decisions. These documents, which also describe the investor rights, can be obtained at any time free of charge on ANIMA website (www.animasgr.it). Hard copies of these documents can also be obtained from ANIMA upon request. The KIDs are available in the local official language of the country of distribution. The Prospectus is available in Italian/English. Past performances are not an indicator of future returns. The distribution of the product is subject to the assessment of suitability or adequacy required by current regulations. ANIMA reserves the right to amend the provided information at any time. The value of the investment and the resulting return may increase or decrease and, upon redemption, the investor may receive an amount lower than the one originally invested.

In case of collective investment undertakings distributed cross-border, ANIMA is entitled to terminate the provisions set for their marketing pursuant to Article 93 Bis of Directive 2009/65/EC.