On the FX space, we think the major impact on the USD of a Trump presidency could derive primarily from the US-China trade war channel and, on a lesser extent, from the US-EU one.

Given that FX plays as the intermediary between countries in international trade, in a world of largely free-floating exchange rates, any actual material government-imposed restrictions should result in a consequent reassessments of exchange rate levels.

We see the terms of trade (ToT) channel as the most important driver of FX valuation following the imposition of tariffs. A tariff acts as a fee paid on imports, which is either absorbed by corporations or passed through to consumers.

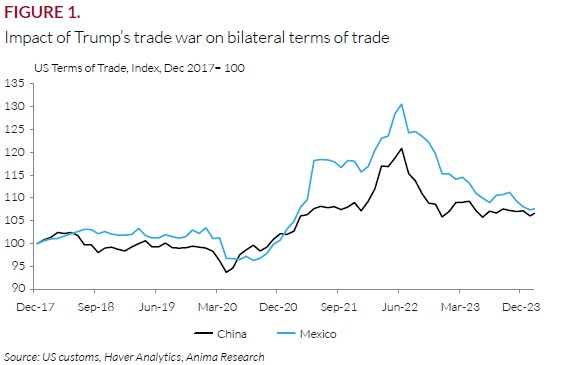

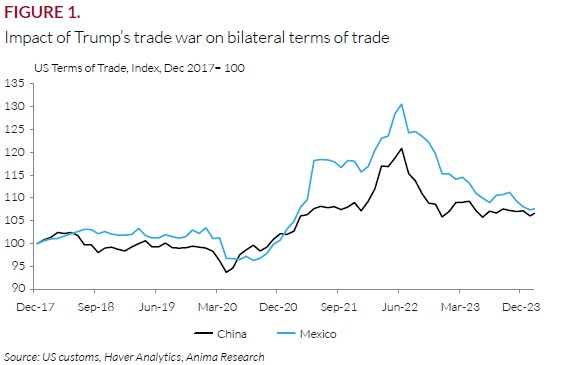

Evidence shows that since 2018, foreign currencies have broadly weakened against the USD (Figure 1), largely benefiting foreign exporters. Under an upcoming second wave of trade wars, we therefore expect that these corporates, which benefited from local currencies devaluation, would be more willing to drop prices to maintain volumes, as they did during the increase in tariff levels in 2018. As a result, our baseline assumption is that US imposed tariffs by an incoming Trump administration would likely act as a positive terms of trade shock in favor of the USD.

Evaluating tariffs through the lens of the ToT also intrinsically captures the relative elasticities of goods. Countries that export m ore elastic goods would be more vulnerable to tariffs, as price changes would have a larger impact on demand. Hence, as a general rule, we expect exchange rates to be more sensitive to ToT for those countries which export more elastic goods rather than less elastic ones.

To empirically measure elasticities of goods, we considered what happened during the previous trade war under the Trump presidency. Therefore, first of all we estimated elasticity of China’s share in US total imports (Figures 2, 3).

The Eurozone was not immune to the global trade dispute unleashed by the US administration in 2018 too. Some industrial sectors (such as steel and aluminum) were heavily impacted, while the overall direct FX impact for the regional economy was contained, as only around EUR6.4bn (less than 1% of EU’s GDP) in EU exports were affected. Furthermore, in 2021 the Biden administration replaced Trump’s tariffs on steel and aluminum with a tariff-based quota system, where the below-quota EU export has been exempted from US tariffs.

Valerio Ceoloni

Senior EM/FX Strategist

Investment Research

Marketing material for professional clients or qualified investors only.

This material does not constitute an advice, an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. ANIMA can in no way be held responsible for any decision or investment made based on information contained in this document. The data and information contained in this document are deemed reliable, but ANIMA assumes no liability for their accuracy and completeness.

ANIMA accepts no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material in violation of this disclaimer and the relevant provisions of the Supervisory Authorities.

This is a marketing communication. Please refer to the Prospectus, the KID, the Application Form and the Governing Rules (“Regolamento di Gestione”) before making any final investment decisions. These documents, which also describe the investor rights, can be obtained at any time free of charge on ANIMA website (www.animasgr.it). Hard copies of these documents can also be obtained from ANIMA upon request. The KIDs are available in the local official language of the country of distribution. The Prospectus is available in Italian/English. Past performances are not an indicator of future returns. The distribution of the product is subject to the assessment of suitability or adequacy required by current regulations. ANIMA reserves the right to amend the provided information at any time. The value of the investment and the resulting return may increase or decrease and, upon redemption, the investor may receive an amount lower than the one originally invested.

In case of collective investment undertakings distributed cross-border, ANIMA is entitled to terminate the provisions set for their marketing pursuant to Article 93 Bis of Directive 2009/65/EC.